Unlocking The Top Secrets of Candlestick Charts Patterns in Crypto Trading

Technical analysis is probably already familiar to you as a cryptocurrency trader. The simple candlestick chart is one of your most effective tools. We’ll dive into the subject of candlestick charts in cryptocurrency trading in this extensive article, going over its varieties, history, patterns, and methods for using them to influence your trading decisions. and must see the Highly Accurate Crypto Chart Patterns for Traders

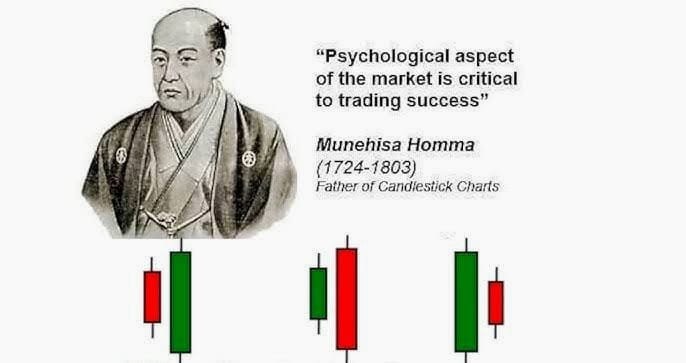

A Brief History of Candlestick Chart Crypto:

In the history of Japan, candlestick charts were first used to track the price of rice. Munehisa the president, a Japanese rice merchant, created the charts in the eighteenth century. Homma was able to see market patterns and make better trading conclusions because to his creative use of candlesticks for price charting.

In the modern day, candlestick charts are a vital tool for traders in a variety of sectors, including cryptocurrency. Traders can see trends, patterns, and possible trading opportunities thanks to the charts’ visual depiction of price movements.

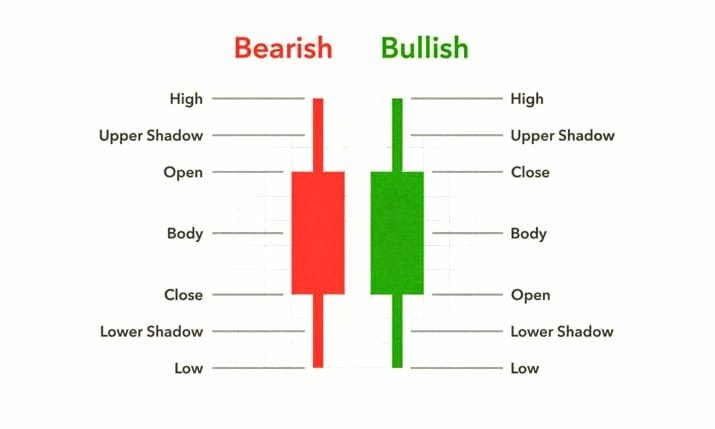

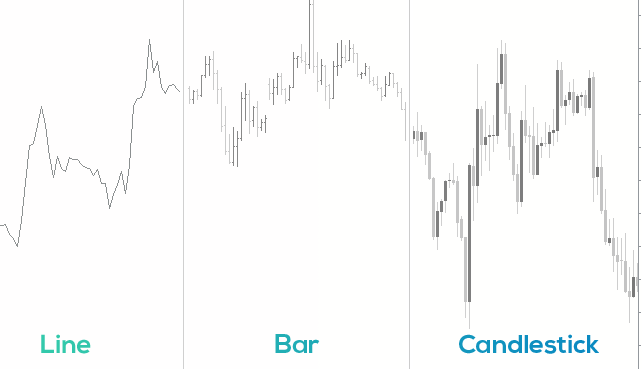

Types of Candlestick Charts Crypto:

Candlestick charts come in a variety of forms, each having special traits and applications. Some of the most popular kinds of candlestick charts are as follows:

1) Line Chart

The most basic kind of candlestick chart is a line chart. With a line connecting each point on the chart, it shows the asset’s closing price over time.

2) Bar Chart

Similar to a line chart, a bar chart shows an asset’s high, low, and closing values over time.

3) Candlestick Chart

The most popular chart type in technical analysis is the candlestick chart. With each candlestick signifying a distinct time period, it shows the asset’s high, low, and closing values throughout time.

4) Heikin Ashi Chart

A Heikin Ashi chart is a type of candlestick chart that uses a modified formula to calculate the candlestick values. This chart is useful for identifying trends and filtering out noise.

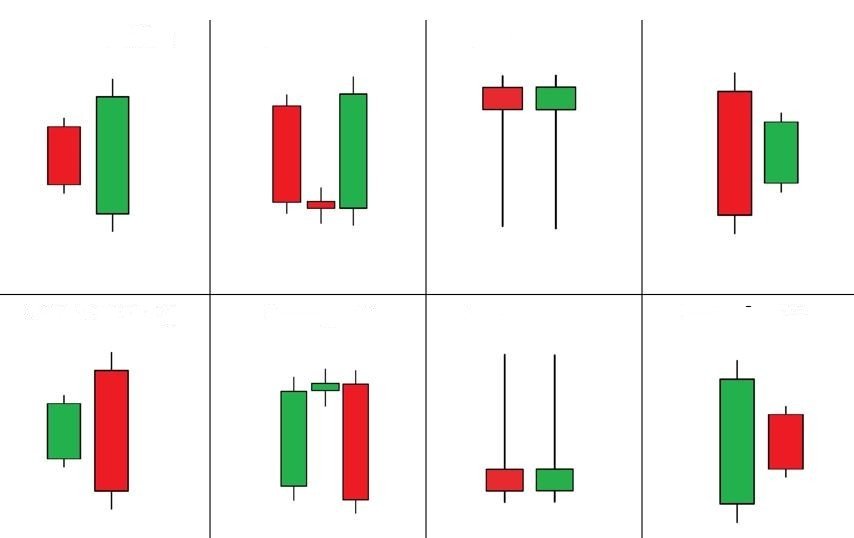

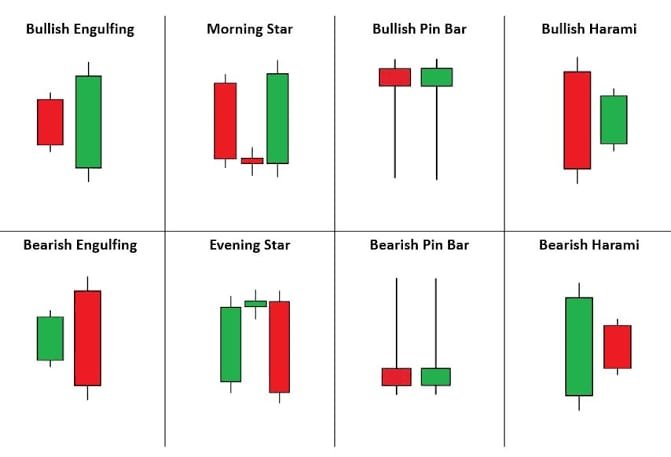

Candlestick Patterns in Crypto Trading

An essential component of technical analysis in cryptocurrency trading is candlestick patterns. Traders may use these patterns to spot trends, forecast price changes, and make wise trading choices. In cryptocurrency trading, the following are a few of the most popular candlestick patterns:

1) Hammer Pattern

A hammer pattern is a bullish reversal pattern that forms when a cryptocurrency’s price declines significantly during a trading session, but then rallies to close near the high of the session.

2) Shooting Star Pattern

When the price of a cryptocurrency rises sharply during a trading session, it subsequently falls to close close to the day’s low, creating a bearish reversal pattern known as a shooting star.

3) Bullish Engulfing Pattern

When the price of a cryptocurrency drops during a trading session but then rises to close above the previous session’s high, a reversal pattern known as a bullish engulfing pattern is created.

4) Bearish Engulfing Pattern

When the price of a cryptocurrency rises during a trading session but then falls to close below the previous session’s low, a reversal pattern known as a bearish engulfing pattern is created.

5) Doji Pattern

A doji pattern is a neutral pattern that appears when there is little to no price movement throughout a trading session and the price of a cryptocurrency begins and closes at the same level.

Strategies for Using Candlestick Charts in Crypto Trading

Among cryptocurrency traders, candlestick charts are an effective tool since they provide information about market movements and possible trading opportunities. The following are some methods for trading cryptocurrencies using Candlestick Chart Crypto

1) Trend Identification

Use candlestick charts to identify trends in the cryptocurrency market. Look for patterns such as higher highs and higher lows to confirm an uptrend, and lower highs and lower lows to confirm a downtrend.

2) Pattern Recognition

To identify patterns like hammer, shooting star, bullish engulfing, and bearish engulfing, use candlestick charts. You may use these patterns to forecast price changes and make wise trading choices.

3) Support and Resistance

To determine levels of support and resistance in the bitcoin market, use candlestick charts. To guide your trading selections, look for regions where the price has reversed or bounced off.

4) Risk Management

To determine levels of support and resistance in the bitcoin market, use candlestick charts. To guide your trading selections, look for regions where the price has reversed or bounced off.

Common Mistakes to Avoid When Using Candlestick Charts

Although candlestick charts are an effective tool for cryptocurrency traders, there are a few typical blunders to steer clear of. The following are a few of the most typical errors:

1) Overreliance on Patterns

Don’t base your trading decisions too much on Candlestick Chart Crypto. Rather, employ them in combination with other technical and fundamental analytical methods.

2) Ignoring Context

Don’t ignore the context in which a candlestick pattern forms. Consider the overall market trend, trading volume,

Conclusion

For cryptocurrency traders, candlestick charts are an effective tool since they provide information about market movements and possible trading opportunities. You may enhance your trading abilities and raise your chances of success in the cryptocurrency market by learning the many kinds of Candlestick Chart Crypto patterns, how to spot them, and how to utilise them to guide your trading decisions.

Always maintain discipline, think about several time periods, and utilise stop-loss orders to reduce your losses. You may become an expert at candlestick chart interpretation and advance your cryptocurrency trading with time and practice.