Crypto Blockchain Analysis: The Ultimate Guide for Smarter Trading

In the fast-paced world of bitcoin trading, keeping ahead needs more than just market instincts. By deciphering blockchain data, cryptocurrency blockchain analysis has become a game-changer, providing traders with useful information. This manual delves deeply into the ways that crypto blockchain analysis turns unstructured data into tactical advantages, guaranteeing well-informed choices in erratic markets. Gaining proficiency with this instrument is crucial for increasing earnings and lowering risks, regardless of your level of experience as a trader. Let’s examine how trading tactics are altered by Crypto Blockchain Analysisstudy.

What Is Crypto Blockchain Analysis?

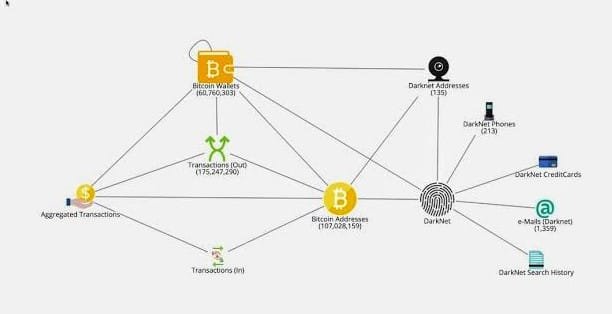

The technique of looking over blockchain transactions to find trends, patterns, and irregularities is known as crypto blockchain analysis. A transparent trail is created by recording each bitcoin transaction on a public ledger. Traders can follow capital transfers, spot questionable activity, and discover whale movements by examining these statistics. Large volumes of raw data are transformed into easily assimilated insights using this technique. In the end, crypto blockchain research helps to close the gap between data and trading techniques that can be put into practice.

Blockchains like Bitcoin and Ethereum are decentralized, but their transparency allows anyone to audit transactions. Crypto blockchain analysis leverages this openness to predict market shifts. For example, large transfers to exchanges often signal impending sell-offs. Traders using crypto blockchain analysis can anticipate such moves and adjust their positions. This proactive approach is why institutional investors heavily rely on these techniques.

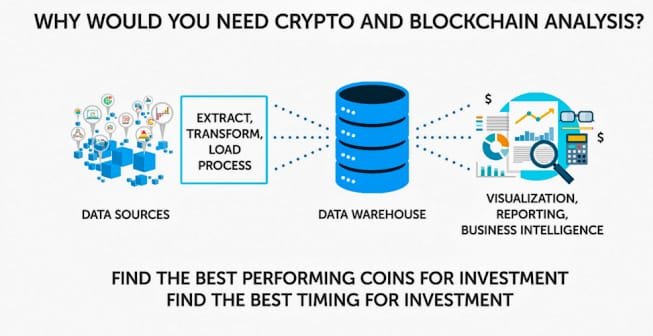

How Does Crypto Blockchain Analysis Work?

At its core, crypto blockchain analysis involves tracking wallet addresses and transaction histories. Advanced algorithms cluster addresses to identify entities, even if they use multiple wallets. For instance, if a wallet linked to a known institution receives a large sum of Bitcoin, it may indicate institutional accumulation. Tools for crypto blockchain analysis map these connections, revealing market sentiment.

Data visualization is another critical component. Platforms like Chainalysis and Elliptic transform complex blockchain data into charts and graphs. Traders use these visuals to spot trends, such as rising exchange inflows or dormant wallets reactivating. By integrating crypto blockchain analysis with market indicators, traders gain a 360-degree view of opportunities and risks.

The Role of Crypto Blockchain Analysis in Trading:

Analysis of cryptocurrency blockchains enables traders to make informed choices. Traders might anticipate price fluctuations before they happen by keeping an eye on whale behaviour. For instance, a price decline is frequently preceded by a whale moving 10,000 BTC to an exchange. Retail traders may level the playing field versus institutional players by replicating these findings using crypto blockchain analysis.

Risk management also benefits from crypto blockchain analysis. Tracking stolen funds or scam tokens helps avoid fraudulent investments. Platforms flag high-risk wallets, enabling traders to steer clear of shady projects. Additionally, crypto blockchain analysis aids in tax compliance by providing clear audit trails for transactions.

Tools and Techniques for Effective Analysis:

1) Chainalysis:

A leader in *crypto blockchain analysis, it offers compliance solutions and market intelligence.

2) Nansen:

Tracks “smart money” wallets to identify trending tokens.

3) Glassnode:

Provides on-chain metrics like exchange reserves and miner activity.

These tools automate crypto blockchain analysis, saving traders hours of manual research. Combining them with technical analysis (e.g., RSI, MACD) creates a robust strategy. For example, if on-chain data shows accumulation while the RSI indicates oversold conditions, it’s a strong buy signal.

Case Studies: Success Stories Using Blockchain Analysis:

In 2021, crypto blockchain analysis detected a massive Bitcoin transfer from a dormant wallet linked to Mt. Gox. Traders anticipating a sell-off shorted BTC, profiting from the subsequent 15% drop. Similarly, analysts spotted Terra’s UST reserves depleting months before its collapse. Those leveraging crypto blockchain analysis exited positions early, avoiding massive losses.

Future Trends in Crypto Blockchain Analysis:

AI integration will revolutionize crypto blockchain analysis by predicting trends with higher accuracy. Regulatory frameworks will also expand, requiring stricter compliance checks. Privacy coins like Monero pose challenges, but advancements in forensic analysis are closing gaps. As DeFi grows, crypto blockchain analysis will become indispensable for auditing smart contracts and liquidity pools

Conclusion:

Mastering crypto blockchain analysis is no longer optional—it’s critical for thriving in crypto markets. By decoding blockchain data, traders unlock strategic insights, mitigate risks, and capitalize on opportunities ahead of the crowd. As tools evolve, integrating crypto blockchain analysis into your strategy will ensure you stay competitive. Start exploring these techniques today, and transform raw data into your trading superpower.

2 thoughts on “Best Crypto Blockchain Analysis: Cryptocurrency Trading 2025”