Crypto Arbitrage: Unlocking Profits in Cryptocurrency Trading Bots

In the ever evolving world of cryptocurrency traders are constantly seeking strategies to maximize profits while minimizing risks.one such strategy that has gained significant attention is crypto arbitrage.This method involves exploiting price discrepancies of digital assets across different markets to secure risk free gains.in this comprehensive guide well delve into the nuances of crypto arbitrage its various forms benefits potential risks and how traders can effectively implement this strategy.

Understanding Crypto Arbitrage:

Crypto arbitrage is a trading technique where investors capitalize on the price differences of a cryptocurrency between two or more exchanges.For instance if Bitcoin is priced at $50000 on Exchange A and $50500 on Exchange a trader can purchase Bitcoin on the cheaper exchange and sell it on the more expensive one pocketing the $500 difference excluding transaction fees.This approach leverages market inefficiencies allowing traders to earn profits without exposure to market volatility.

Why Do Price Discrepancies Occur?

Several factors contribute to price differences across cryptocurrency exchanges:

Liquidity Variations: Exchanges with higher trading volumes often have more competitive pricing while those with lower liquidity might exhibit price disparities.

Geographical Influences: Local demand and regulatory environments can impact cryptocurrency prices in different regions.

Exchange Specific Supply and Demand: The number of buyers and sellers on a particular platform can influence asset prices uniquely.

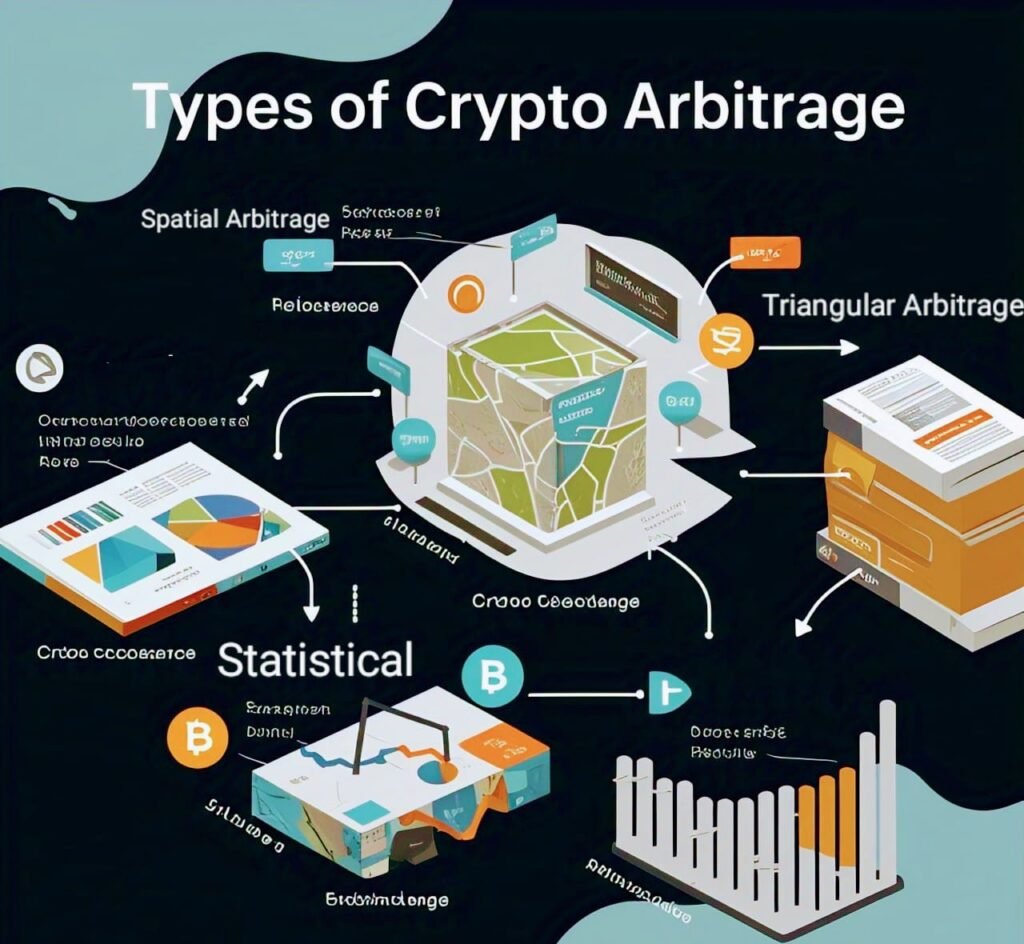

Types of Crypto Arbitrage:

Traders employ various crypto arbitrage strategies to exploit market inefficiencies:

1) Spatial Arbitrage:

This straightforward method involves buying a cryptocurrency on one exchange and selling it on another where the price is higher.The key is to act swiftly before the price gap closes.

2) Triangular Arbitrage:

This strategy takes advantage of price differences between three cryptocurrencies on a single exchange.For example a trader might exchange Bitcoin for Ethereum then Ethereum for Litecoin and finally Litecoin back to Bitcoin profiting from the relative price differences among the three.

3) Statistical Arbitrage:

Utilizing mathematical models and algorithms traders predict price movements and execute trades based on statistical probabilities.This method often involves high frequency trading and requires advanced computational tools.

Benefits of Crypto Arbitrage:

Engaging in crypto arbitrage offers several advantages:

Low Risk: Since trades are executed simultaneously to exploit price differences, exposure to market volatility is minimal

Profit Potential: Even small price discrepancies can lead to significant profits especially when leveraged or executed in high volumes.

Market Efficiency: Arbitrage activities help in aligning prices across exchanges contributing to overall market stability.

Challenges and Risks:

While crypto arbitrage presents lucrative opportunities, traders should be mindful of potential challenges:

Transaction Fees: Fees associated with trading and transferring assets can erode profits.It’s essential to account for these costs when calculating potential gains.

Withdrawal and Deposit Delays: Transferring funds between exchanges can take time during which price discrepancies may diminish.

Regulatory Hurdles: Different countries have varying regulations which can impact the feasibility of arbitrage strategies.

Security Concerns: Storing funds on multiple exchanges increases exposure to potential hacks or security breaches.

Implementing a Crypto Arbitrage Strategy:

To effectively engage in crypto arbitrage consider the following steps:

Research and Selection of Exchanges: Identify reputable exchanges with significant liquidity and favorable fee structures.

Monitor Price Differences: Utilize tools and software that track price discrepancies in real time across multiple platforms.

Automate Trading: Given the speed required for successful arbitrage employing trading bots can enhance efficiency and execution times.

Risk Management: Set clear profit targets and stop loss limits Diversify across different arbitrage opportunities to mitigate potential losses.

Real-World Example:

In a recent instance a crypto trader reportedly earned $300000 by leveraging a simple arbitrage strategy.The trader capitalized on price differences between exchanges executing swift transactions to secure profits.This example underscores the potential profitability of well executed crypto arbitrage strategies.

Conclusion:

Crypto arbitrage serves as a compelling strategy for traders aiming to profit from market inefficiencies.By understanding the various forms of arbitrage recognizing potential risks and implementing robust strategies traders can navigate the cryptocurrency landscape effectively.As with any trading approach thorough research continuous monitoring and prudent risk management are paramount to success in crypto arbitrage.

1 thought on “Top Best Crypto Arbitrage Trading Bots 2025”