Trend Following Trading Bots for Profitable Market Strategies:

In the dynamic world of financial markets traders are continually seeking strategies that can adapt to changing conditions and yield consistent profits.One such approach is trend following trading a method that capitalizes on the momentum of asset prices. With the advent of technology implementing a trend following trading system in bots has become increasingly popular allowing for automation and efficiency in trading operations.

Understanding Trend Following Trading:

Trend following trading is a strategy that aims to identify and capitalize on the direction of market trends.Traders analyze historical and real time data to determine whether an asset is moving upward bullish trend downward bearish trend or sideways neutral trend By entering positions aligned with the prevailing trend traders seek to profit from sustained price movements.

Key characteristics of trend following trading include:

Momentum-Based: Relies on the continuation of existing market trends.

Technical Analysis: Utilizes tools like moving averages Relative Strength Index RSI and Moving Average Convergence Divergence (MACD) to assess market direction.

Rule Based Approach: Follows predefined rules for entering and exiting trades reducing emotional decision making.

The Role of Bots in Trend Following Trading:

Incorporating bots into trend following trading systems offers several advantages:

Automation: Bots can execute trades automatically based on set parameters eliminating the need for manual intervention.

Speed: Bots process data and execute orders at high speeds capitalizing on market opportunities more efficiently than human traders.

Consistency: Bots Adhere strictly to the trading strategy ensuring consistent application without the influence of emotions.

For instance platforms like Oxido Solutions offer automated trend following trading systems designed to capitalize on market volatility.

Key Components of a Trend Following Trading Bot System:

Developing an effective trend following trading system in bots involves several critical components:

1) Strategy Development:

Define the rules and parameters that the bot will follow such as the indicators used to identify trends and the criteria for entering or exiting trades.

2) Risk Management:

Implement measures to manage potential losses including setting stop-loss orders and position sizing to protect the trading capital.

3) Backtesting:

Test the strategy against historical data to evaluate its performance and make necessary adjustments before deploying it in live markets.

4) Continuous Monitoring and Optimization:

Regularly monitor the bots performance and optimize the strategy to adapt to changing market conditions.

Advantages of Using Bots in Trend Following Trading:

Integrating bots into trend following trading systems offers numerous benefits:

Efficiency: Bots can analyze vast amounts of data and execute trades more efficiently than human traders.

Emotion Free Trading: Bots operate based on predefined rules eliminating emotional biases that can affect trading decisions.

24/7 Market Monitoring: Bots can monitor markets continuously ensuring that trading opportunities are not missed especially in markets that operate around the clock like cryptocurrencies.

Challenges and Considerations:

While bots offer significant advantages traders should be aware of potential challenges:

Market Volatility: Bots may struggle in highly volatile markets where trends are short lived or rapidly reversing.

Overfitting: Designing bot too closely aligned with historical data can result in poor performance in live markets.

Technical Issues: Bots are susceptible to technical failures such as connectivity issues or software bugs, which can lead to unintended trading actions.

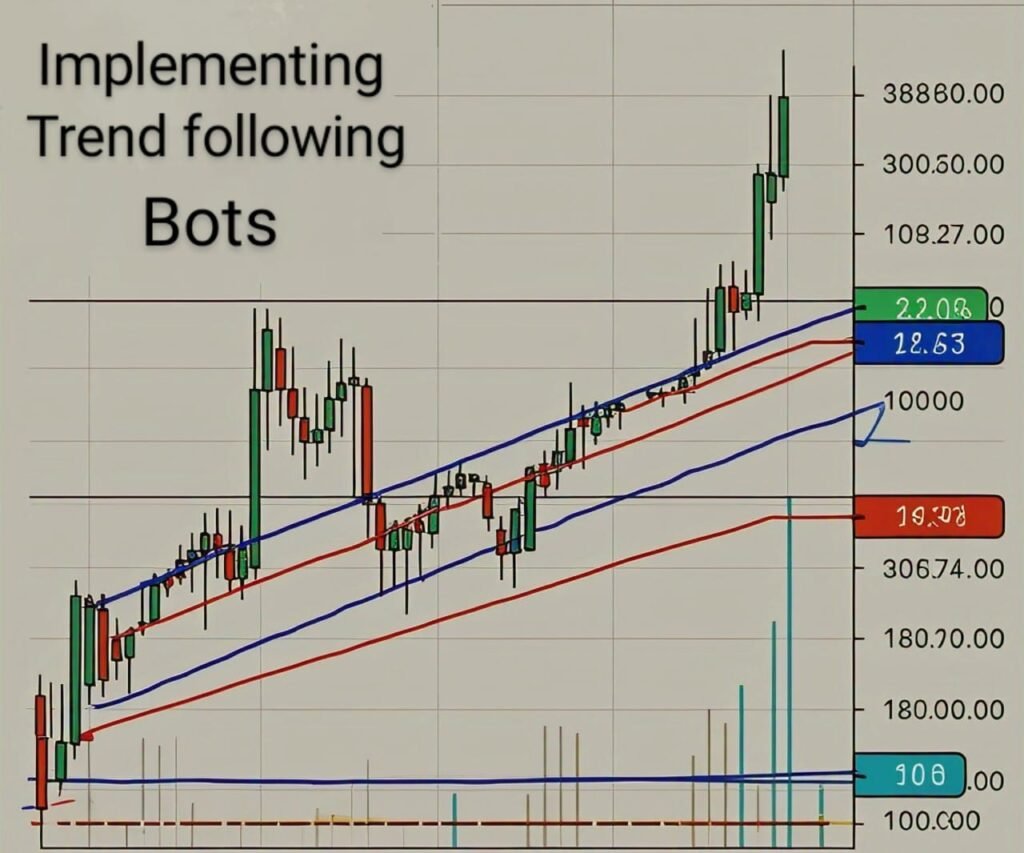

Implementing a Trend Following Trading Bot:

To successfully implement a trend following trading system in bots consider the following steps:

1) Choose the Right Platform:

Select a platform that supports automated trading and offers the necessary tools and integrations. Platforms like Raposa provide user friendly interfaces for designing and testing trading strategies without requiring coding skills.

2) Develop and Test Your Strategy:

Create a strategy based on trend following trading principles, backtest it using historical data to assess its viability.

3) Deploy and Monitor:

Once satisfied with the backtesting results deploy the bot in a live trading environment.continuously monitor its performance and make adjustments as needed to adapt to market changes.

Conclusion:

Incorporating bots into trend following trading systems can enhance efficiency consistency and profitability in trading operations.By automating the execution of well defined strategies traders can capitalize on market trends while mitigating the influence of emotions and human error.However it’s essential to approach automation with careful planning rigorous testing and continuous monitoring to navigate the complexities of the financial markets successfully.

As technology continues to evolve the integration of AI and machine learning into trend following trading bots holds the potential to further refine strategies and adapt to ever changing market dynamics.Staying informed and embracing these advancements can position traders to effectively harness the power of automation in their trading endeavors.

1 thought on “Best Trend Following Trading System Bots 2025”