What is Technical Analysis.

The study of market data, specifically price and volume, in order to forecast the upcoming prices of cryptocurrencies is known as cryptocurrency Technical analysis. To find trends, reversals, and possible trading opportunities, it entails examining charts and patterns.

Types Of Technical Analysis:

1) Charts Patterns

2) Candlestick Patterns

3) Indicators

4) Trend analysis

5) Support and resistance

6) Volume analysis

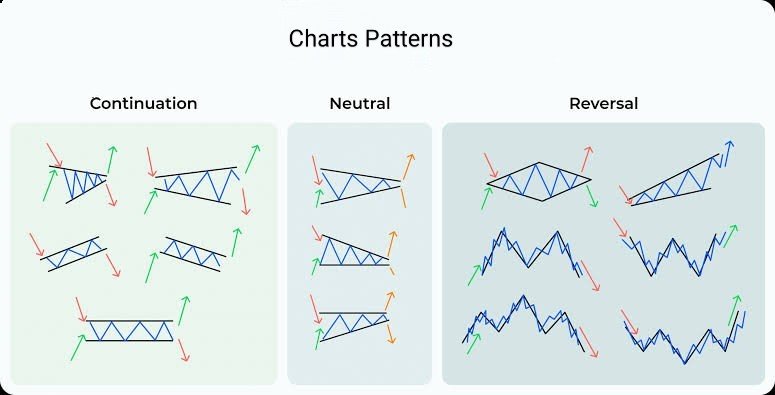

Chart Patterns: Unlocking Trading Opportunities

Chart patterns are pictures of price movements that assist traders in identifying possible trends, reversals, and continuations. These trends offer useful insight on the mood and actions of the market.

Explanation

In Crypto Technical Analysis If you want to identify trends and reversed patterns, chart patterns are essential in cryptocurrency trading. When the The opposite direction Head and Shoulders pattern indicates a bullish reversal, the Head and Shoulders pattern suggests a possible downtrend. Triangles and wedges represent patterns of continuation or reversal. Short-term reversals are indicated by the Hammer and Shooting Star candlestick patterns. By identifying these trends, traders may efficiently manage risk by improving entry and exit places of business. Technical indicators and chart patterns can be used to help cryptocurrency traders make sensible decisions.

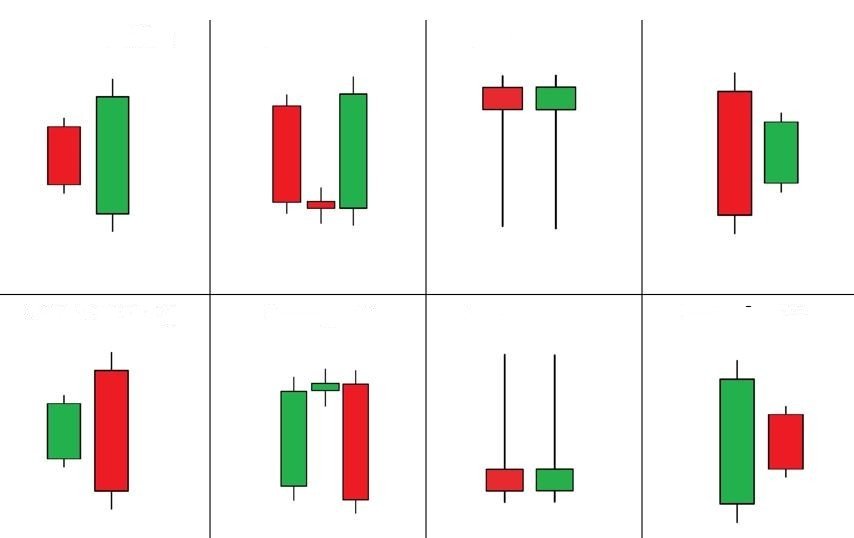

Candlestick Patterns : A Comprehensive Guide

In cryptocurrency Technical Analysis. candlestick patterns are graphical representations of price changes that show the mood of the market and possible changes. These trends, which are based on Japanese rice trade, offer important information on the direction of trends and crowd behavior. Crypto Technical Analysis. Types Of Technical analysis 2024.Crypto traders optimize transactions by making knowledgeable opinions based on the analysis of candlestick patterns.

Explanation

As they present market information, candlestick patterns serve a purpose in cryptocurrency trading. Through showing price fluctuations, these patterns help people make well-informed conclusions. Reversal patterns are indicated by the Hammer and Shooting Star patterns, and sluggish is shown by the Dojo. Bearish/Bullish Trend reversals are confirmed by engulfing patterns. Technical indicators and candlestick patterns function together to provide accuracy. Hammer, Dojo, and Piercing Line are examples of common patterns. While continuation patterns validate trends, reversal patterns forecast shifts in trends. Traders may maximize their entry and exit points by using candlestick analysis. Market context and practice are necessary for effective pattern recognition. Developing experience with candlestick patterns improves the profitability and trading tactics of cryptocurrencies.

Indicators in Crypto Trading: A Comprehensive Guide

In Crypto Technical Analysis. and types Of technical analysis Indicators are served as crucial tools in crypto trading, helping traders make informed decisions. These mathematical algorithms analyze price movements, volume, and other market data to predict future trends

Explanation

When trading cryptocurrencies, indicators are necessary for making informed choices. To forecast price changes and trends, they examine market data. Indicators optimize trading timing, control risk, and spot buy/sell indications. Trend indicators (MA, Bollinger Bands) predict market direction. Strength and possible reversals are measured by momentum indicators (RSI, MACD). OBV and ADL, two volume indicators, evaluate trading activity. Price changes are measured by volatility indicators (ATR, BB). Traders can better grasp market mood and changes in sentiment by using indicators. Crypto Technical Analysis. Types Of Technical analysis 2024 Profitability and trading methods are improved by using indicators effectively. Success depends on precise market research and well-informed choices.

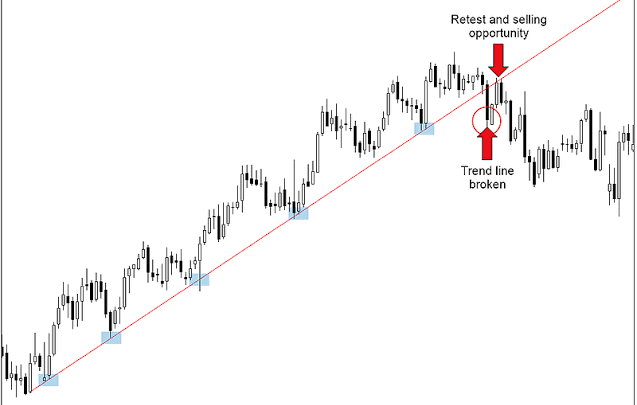

Trend Lines in Crypto Trading: A Key to Success

In Crypto Technical Analysis.and types Of technical analysis 2024 is a trend line is a diagram that shows the direction of the market by connecting an arrangement of highs or lows.

It forecasts future price fluctuations by exposing underlying tendencies.

Trend lines make market analysis easier by pointing out possible breakouts and reversals.

Higher lows are connected by uptrend lines, and lower highs are connected by downtrend lines.

Trend lines optimise entry/exit positions and help traders make well-informed selections.

Explanation:

Trend lines are fundamental tools in technical analysis, connecting highs or lows to identify market direction. They reveal underlying trends, predicting future price movements. Uptrend lines connect higher lows, signaling bullish markets. Downtrend lines connect lower highs, indicating bearish markets. Trend lines simplify market analysis, identifying reversals and potential breakouts. Trend lines aid traders in making informed decisions, optimizing entry/exit points. They help set stop-loss levels, limiting potential losses. Multiple trend lines enhance analysis, confirming market directions. Combining trend lines with indicators strengthens trading strategies. Trend lines adapt to changing market conditions. Adjusting trend lines reflects shifting market sentiment.

Example:

Breakouts or breakdowns signal trend reversals. Trend line angles indicate market momentum. Steep trend lines suggest aggressive markets. Shallow trend lines indicate stable markets. Internal trend lines identify smaller market movements. Lines of external trends Examine more general market patterns. Practice and market context are necessary for trend line analysis to be effective. Gaining proficiency with trend lines improves trading tactics and financial gain. Cryptocurrency markets are no exception to trend lines. Other technical indicators are enhanced by trend line analysis.

Support and Resistance in Crypto Trading:

In Crypto Technical Analysis.and types Of technical analysis 2024 Support and resistance levels are crucial concepts in technical analysis, helping traders identify potential price reversals and make informed decisions.

Explanation:

Support and resistance levels are pivotal in technical analysis. They indicate potential price reversals and trend changes. Support levels are price floors where buyers intervene. Resistance levels are price ceilings where sellers step in. Identifying these levels optimizes entry/exit points. Traders manage risk by setting stop-loss orders. Combining support/resistance with indicators strengthens analysis. Market sentiment and context consider trend reversals. Horizontal, diagonal, psychological, and historical levels exist. Mastering support/resistance enhances trading strategies and profitability.

Types of Support and Resistance

- Horizontal support/resistance: specific price levels.

- Diagonal support/resistance: trend lines.

- Psychological support/resistance: round numbers.

- Historical support/resistance: previous highs/lows.

- Dynamic support/resistance: moving averages.

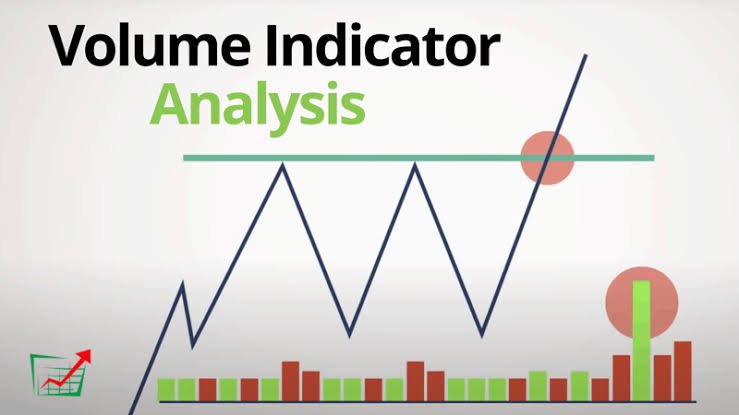

Volume Analysis: Unlocking Market Secrets

Crypto Technical Analysis. Types Of Technical analysis 2024volume analysis is a formidable tool that traders may use to assess market sentiment, validate trends, and spot possible reversals. In order to get insight into market activity, investor interest, and possible price moves, volume analysis looks at the number of shares exchanged over a certain time period.

Explanation:

Volume analysis examines trading activity to gage market sentiment and confirm trends. It measures the number of shares traded over a specific period. High volume indicates strong market interest, while low volume suggests lack of interest. Volume trends reveal upward or downward movements. Bullish volume increases during upward price movements. Bearish volume rises during downward price movements. Volume climax signals potential reversals. Volume divergence indicates discrepancies between volume and price. Effective volume analysis refines trading strategies and optimizes profitability.

Conclusion:

In order to succeed in bitcoin markets and make wise trading decisions, technical analysis is an essential tool. Multiple indicators are combined, market circumstances are adjusted, and risk is managed by effective tactics. Gaining proficiency in technical analysis reduces losses and increases trading profitability.

2 thoughts on “Crypto Technical Analysis. Types Of Technical analysis 2024”