Why Elliott Wave Theory is a Crypto Trader’s Secret Weapon:

In the Elliott Wave Trading Cryptocurrency markets are a wild frontier of euphoric rallies and gut-wrenching crashes. While most traders chase hype or panic-sell at the wrong time, a select few use Elliott Wave Theory to stay ahead of the herd. This 85-year-old market analysis framework isn’t just for stocks or forex—it’s perfect for crypto’s volatility. Why? Because it decodes the emotional chaos driving Bitcoin, Ethereum, and altcoins into actionable patterns.

What is Elliott Wave Theory? (And Why It Works for Crypto)

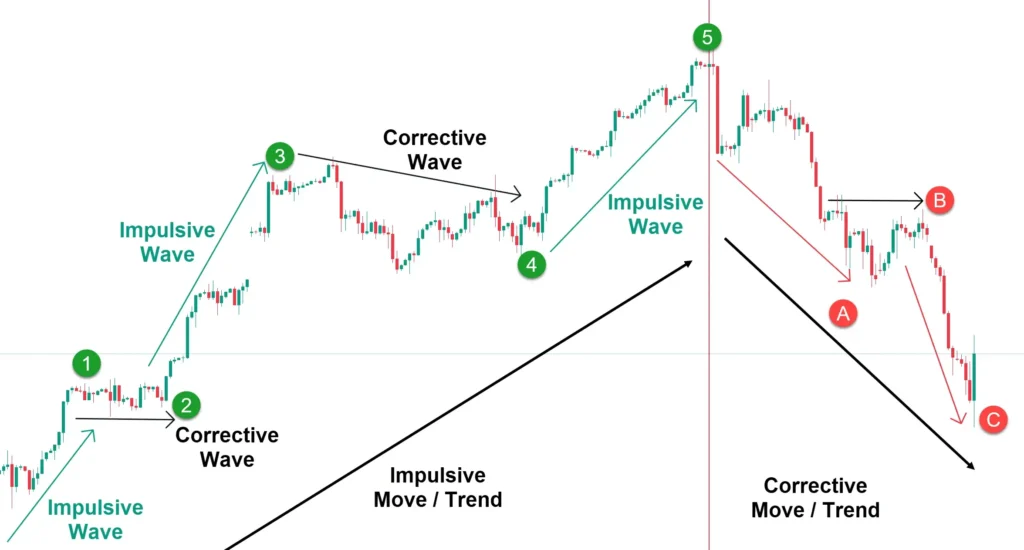

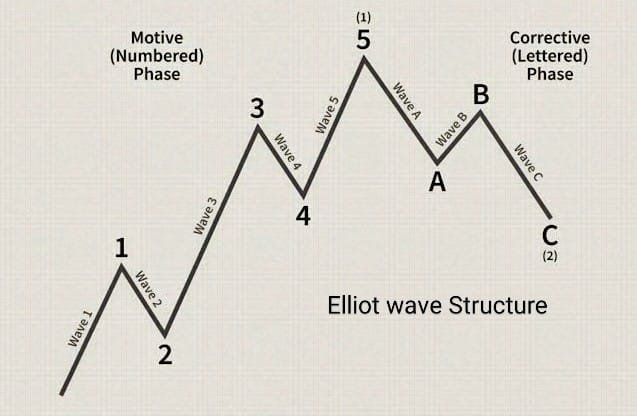

Ralph Nelson Elliott’s 1938 theory argues that financial markets move in repetitive, fractal patterns driven by mass psychology. These patterns split into two phases:

1) Impulsive Waves (1-5)

The trend-driven phase where prices surge or crash.

2) Corrective Waves (A-B-C):

The counter-trend phase where markets “breathe” before resuming the trend.

Why Crypto Traders Swear By It:

1) 24/7 Markets = Cleaner Patterns:

Unlike stocks, crypto never sleeps, amplifying emotional extremes and creating clearer wave structures.

2) Altcoin Opportunities:

Spot early impulsive waves in projects like Solana or Avalanche before they pump 200%.

3) Bitcoin Halving Cycles:

Time long-term investments using Wave 4 corrections (often aligning with pre-halving sell-offs).

Cracking the Elliott Wave Code: A Step-by-Step Framework

1) Identifying Impulsive Waves (The Money-Making Phase)

Wave 1:

A stealthy rally, often mistaken for a dead cat bounce. Example: Bitcoin’s Q1 2023 rebound from $16k to $25k

Wave 3:

The “sweet spot” where FOMO kicks in. Prices skyrocket, and skeptics turn into believers.

Wave 5:

The euphoric peak. Warning: Retail traders pile in here before the trend reverses.

Pro Tip:

Use Fibonacci extensions to predict Wave 3 targets. If Wave 1 rises 30%, Wave 3 often stretches 161.8% of that move.

2) Navigating Corrective Waves (A-B-C Pullbacks)

Wave A:

Sharp sell-offs as early bulls take profits.

Wave B:

A deceptive relief rally (a bull trap!).

Wave C:

The final capitulation before the trend resumes.

Advanced Elliott Wave Trading Hacks for Crypto:

1) RSI Divergence:

If Wave 5 hits a new high but RSI trends downward, a reversal is near (see Bitcoin’s 2021 $69k top).

2) Truncated Fifths:

When Wave 5 falls short of expectations, it signals exhaustion (common in meme coins like SHIB).

3) Time Cycles:

Bitcoin’s 4-year halving often aligns with Wave 4 corrections. Mark your calendar for 2024!

Common Elliott Wave Mistakes (And How to Avoid Them)

Mistake 1

Mislabeling Waves. Fix: Wait for confirmation (close above Wave 1 high for Wave 3).

Mistake 2

Ignoring Volume. Rising volume in Wave 3 validates the trend.

Mistake 3

Overlooking Larger Timeframes. A daily Wave 5 could be part of a weekly Wave 2.

Tools to Automate Elliott Wave Analysis:

TradingView:

Use the built-in Elliott Wave indicator to spot patterns on BTC/USD charts.

TrestoWave:

AI-powered software that scans altcoins for Wave 3 setups.

Fibonacci Tools:

Map retracements (38.2%, 50%, 61.8%) to predict pullback depths.

Elliott Wave Trading Plan: A Checklist*

- Identify the larger trend (weekly/monthly charts).

- Zoom into 4-hour/day charts to label waves.

- Set stop-loss below Wave 1 low (impulsive) or Wave A high (corrective).

- Enter at the start of Wave 3 or end of Wave C.

- Take profit at Fibonacci extension levels (123.6%, 161.8%).

Conclusion:

Elliott Wave Theory isn’t just about lines on a chart—it’s about understanding greed, fear, and the herd mentality that moves crypto markets. By mastering these patterns, you’ll stop chasing pumps and start anticipating them. Remember:

- Patience pays. Wait for Wave 3 confirmations.

- Combine Elliott Waves with fundamentals (e.g., Fed rate hikes, Ethereum upgrades).

- Practice on historical charts before risking capital.