What is Chart Patterns: Unlocking Trading Opportunities

Crypto Chart Patterns are graphical picture of price movements on financial charts, helping traders identify potential trends, reversals, and continuations. These patterns provide valuable insights into market sentiment and behavior. this is called Crypto Chart Patterns and best website for Crypto Chart Patterns Analysis is Trading view

Explanation:

Crypto chart patterns forecast price changes by analysing market trends. Head and Shoulders and other reversal patterns indicate shifts in the trend. Triangles and wedges are examples of continuation patterns that validate the momentum of a trend. Whereas bearish patterns (Shooting Star, Dark Cloud Cover) imply downward movements, bullish patterns (Hammer, Piercing Line) indicate upward moves. Profitability is maximised and trading techniques are improved by mastering these patterns.

Types of Chart Patterns:

There are many types of crypto chart patterns, but there are three types that will make your trading journey easier. One is the reversal chart pattern, the second is the continuation chart pattern, and the third is the breakout chart pattern.

1) Reversal Crypto Chart Patterns:

2) Continuation Crypto Chart Patterns:

Reversal Chart Patterns

Significant trend reversals in cryptocurrency markets are highlighted by reversal chart patterns. A bearish reversal is indicated by the Head and Shoulders pattern, which is defined by three following high. Bullish reversals are offered up by negative head and shoulders patterns. Reversals are often indicated by double top and double bottom patterns. Recognising these trends enables traders to modify their tactics and maximise profits.

Explanation:

Future trend reversals in cryptocurrency markets are identified by reversal Crypto Chart Patterns. These trends assist traders in anticipating and adjusting towards shifts in the market. Head and Shoulder Opposite H&S, Double Top/Bottom, and Triple Top/Bottom are samples of standard reversal patterns. Bullish reversals are marked by inverse H&S patterns, whilst bearish reversals are suggested by H&S patterns. Long-term trends can give rise to reversal patterns. Bollinger Bands, RSI, and moving averages are important indicators. Trend reversals get recognized by volume analysis. Confirmation of breakouts and breakdowns is crucial. Gains have been maximized and losses are minimized via efficient recognition and interpretation. Gaining proficiency with reversal patterns improves trading tactics and financial gain.

Top Highly Accuracy Reversal Chart Patterns:

- Double top pattern

- Double bottom pattern

- Head and shoulders pattern

- Triple top and triple bottom pattern

- Sushi roll pattern

- Quasimodo pattern

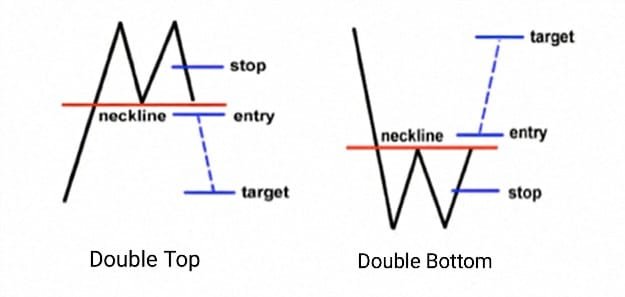

Double Tops and Bottoms Patterns:

Two unsuccessful efforts by the price to break above a significant resistance level or below a significant support level are represented by double tops and double bottoms. Increasing selling pressure after an uptrend enters overbought territory or increased purchasing pressure after a downtrend dips too deeply might be signs that momentum has been lost in this trend.

Triple tops and triple bottoms are a similar reversal pattern. The fact that the price did not break out three times rather than simply twice, indicating a greater degree of support or resistance, makes this movement much more potent.

.

Head and shoulders patterns:

The head and shoulders are made up of three parts: the shoulder, which is the higher peak on the left, and the shoulder, which is the higher peak on the right. By joining the two bottoms—the one before and the one after the head formation—the “neckline” is created. This line is crucial since the signal is triggered by a break below. The graphic below displays both the bullish and bearish reversal patterns.A reversal chart pattern that resembles the head and shoulders but is inverted is called the inverse head and shoulders, or “head and shoulders bottom.”

Three consecutive lows make up the pattern, with the head, or middle low, being deeper than the shoulders, or outer lows. When this pattern is finished

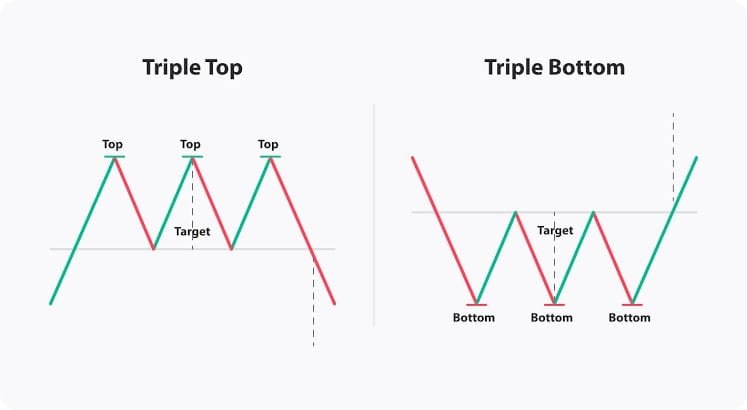

Triple tops and Triple bottoms patterns:

A Triple top indicates that the asset may no longer be heading upward and that lower prices are likely to follow. It is made up of three peaks that almost reach the same price level. The triple top can happen in any time frame, but in order for the pattern to be taken into consideration, it must follow an upward trend. The ‘M’ on a candlestick chart is the representation of this chart reversal pattern.

The reverse of a triple top, the triple bottom is a chart pattern that resembles the letter “W” and happens following a downward trend. The three bottoms will all hit around the same price level before breaking through resistance levels.

Sushi roll Pattern:

Mark Fisher came up with the idea for the sushi roll reversal pattern while having lunch with other traders. They were discussing trade setups, and Fisher considered the possibilities of mixing narrow and wide price ranges.The ‘inner pattern’ that Fisher initially used consisted of ten consecutive values that fell within a very specific range. The ‘outside pattern’ was the second series that came after, which contained five price bars that encompassed the first price bar series.

The pattern is applicable to any time period and can assist traders in identifying possible market reversals through a combination of inside and outside trading. One advantage of adopting this pattern is that, in comparison to chart patterns like head and shoulders or double bottoms, it indicates a possible price reversal more earlier.It is important to use this chart reversal pattern in combination with other technical indicators and candlestick patterns, even though it does offer some excellent insight into the possible top and bottom for the asset you are tracking.

Quasimodo pattern:

The Quasimodo pattern, also known as the “over and under pattern,” is relatively new to the technical analysis trend reversal patterns group.Despite its seeming complexity, the Quasimodo Pattern is actually rather simple to recognise. When a trader notices this pattern, it typically gives them a comprehensive understanding of the market and boosts their confidence in trades that take place close to either support or resistance levels on the charts. Therefore, it may be worthwhile to take advantage of both possibilities by raising your position size and modifying your stop losses if you are waiting for divergence setups before closing your trade and simultaneously discover a Quasimodo pattern. If a sequence of lower highs, lower lows, higher highs, or higher lows is broken after a notable, evident trend, the reversal pattern can be observed. Many traders view this chart pattern as one of the most dependable and potent patterns to trade, thus it’s vital to recognise it and act fast because it can repeat itself continuously.

Continuation Chart Patterns :

Cryptocurrency continuation crypto chart patterns signal a break in the current trend before it resumes. Triangles, wedges, flags, and pennants are examples of common patterns. These patterns imply that following consolidation, trend momentum will persist. Traders can better position themselves for possible breakouts by recognising continuation patterns. Profitability and trading tactics are improved by accurate identification.

Explanation:

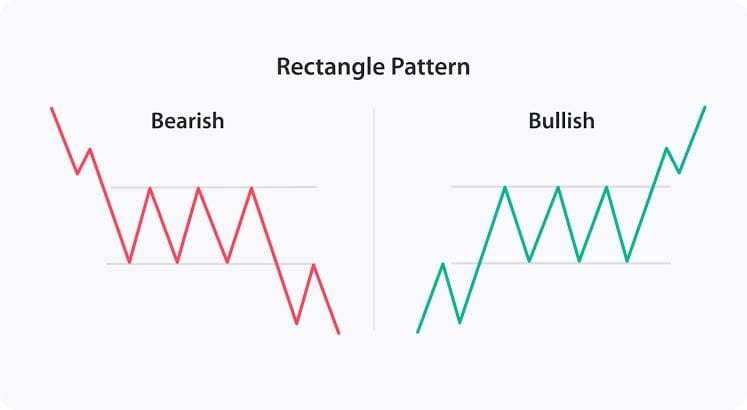

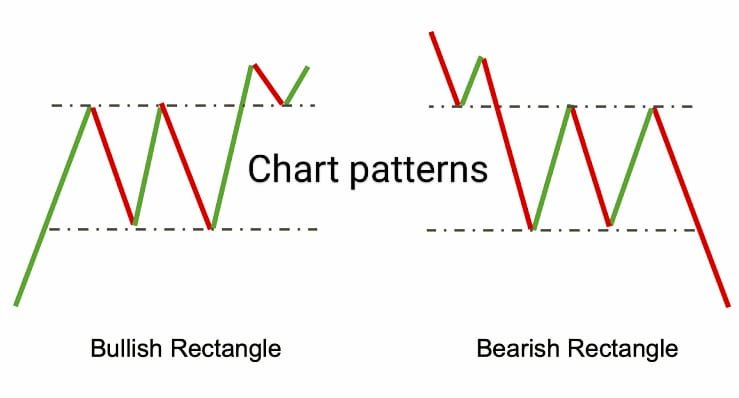

In cryptocurrency trading, continuation chart patterns are visual cues that suggest the current trend, whether bullish or negative, is probably going to continue following a brief period of consolidation. During brief lulls in market momentum, when price movement consolidates before resuming the dominant trend, these Crypto Chart Patterns appear. Triangles, rectangles, pennants, and flags are examples of common continuation patterns that provide distinct insights on price behaviour. Following significant price changes, flags and pennants frequently develop, with the breakout direction usually following the initial trend with Crypto Chart Patterns.

Depending on the breakout side, triangles, such as ascending or descending triangles, indicate a continuation and display convergent price levels. Rectangles exhibit horizontal consolidation, in which the price moves back and forth between levels of support and resistance before continuing on its current trajectory. Traders anticipate breakouts that follow the prevailing market direction and utilise these patterns to determine possible entry and exit opportunities. Technical analysis relies heavily on continuation patterns, which enable traders to profit from the volatility of the cryptocurrency market while efficiently controlling risk. Traders can improve their chances of success by matching their strategies with the market’s momentum by comprehending these Crypto Chart Patterns.

Top Highly Accuracy Continuation Chart Patterns:

- Rectangle patterns

- Triangle continuation patterns

- Pennant patterns

- Wedge patterns

- Cup and handle patterns

Continuation Chart Patterns:

Cryptocurrency continuation chart patterns signal a break in the current trend before it resumes. Triangles, wedges, flags, and pennants are examples of common patterns. These patterns imply that following consolidation, trend momentum will persist. Traders can better position themselves for possible breakouts by recognising continuation patterns. Profitability and trading tactics are improved by accurate identification.

Explanation:

In cryptocurrency trading, continuation chart patterns are visual cues that suggest the current trend, whether bullish or negative, is probably going to continue following a brief period of consolidation. During brief lulls in market momentum, when price movement consolidates before resuming the dominant trend, these patterns appear. Triangles, rectangles, pennants, and flags are examples of common continuation patterns that provide distinct insights on price behaviour. Following significant price changes, flags and pennants frequently develop, with the breakout direction usually following the initial trend.

Depending on the breakout side, triangles, such as ascending or descending triangles, indicate a continuation and display convergent price levels. Rectangles exhibit horizontal consolidation, in which the price moves back and forth between levels of support and resistance before continuing on its current trajectory. Traders anticipate breakouts that follow the prevailing market direction and utilise these patterns to determine possible entry and exit opportunities. Technical analysis relies heavily on continuation patterns, which enable traders to profit from the volatility of the cryptocurrency market while efficiently controlling risk. Traders can improve their chances of success by matching their strategies with the market’s momentum by comprehending these Crypto Chart Patterns

Top Highly Accuracy Continuation Chart Patterns:

- Rectangle patterns

- Triangle continuation patterns

- Pennant patterns

- Wedge patterns

- Cup and handle patterns

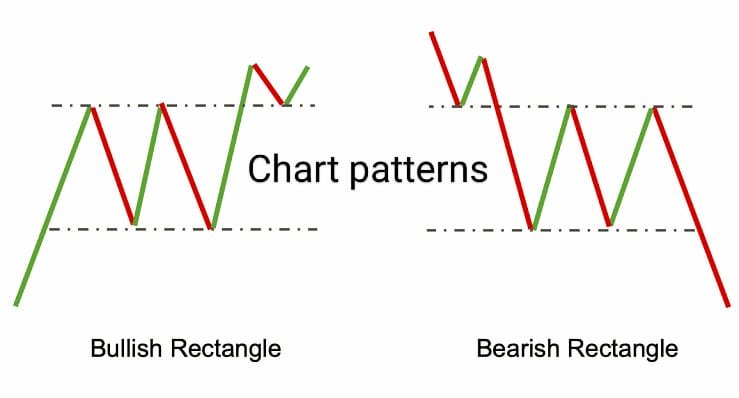

Rectangle Patterns

When the price repeatedly hits horizontal support and resistance levels, rectangle patterns are created. As a result, the price is limited, forming a rectangle as it oscillates between the horizontal levels. Eventually, the price will break out, and the trend will go in either an upward or downward direction.

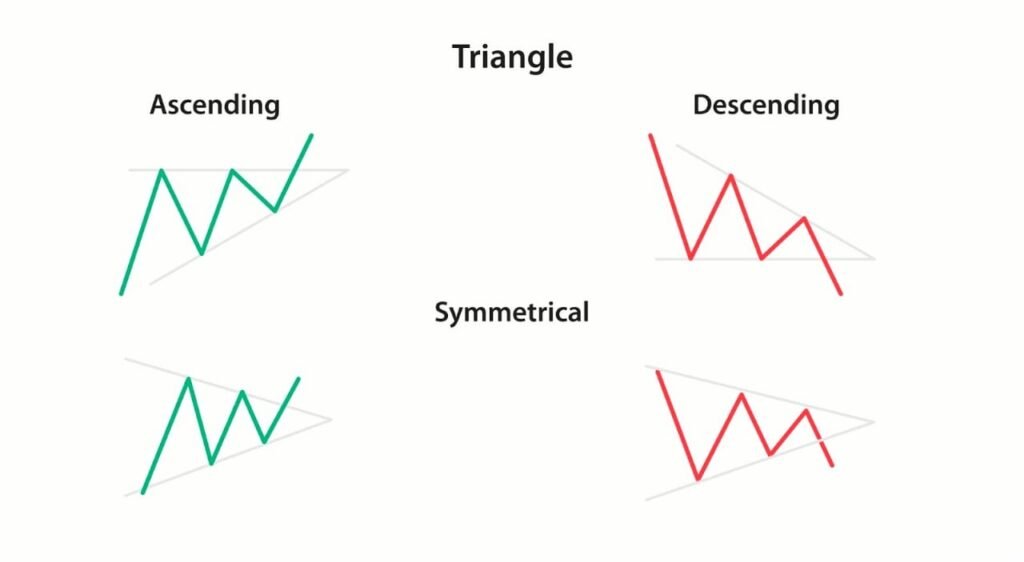

Triangle continuation patterns:

Technical analysts frequently employ triangle patterns as continuation patterns. Triangle patterns come in three distinct forms, and knowing about them is important since they may be used to determine whether a market is bullish or bearish. They are triangles that are symmetrical, ascending, and descending.

The triangle starts to develop at its broadest point, and as the market continues to move sideways, the trading range gets smaller, completing the triangle’s full configuration at its apex. Similar to wedges and pennants, this chart pattern is frequently referred to as a horizontal trading pattern. Bullish or bearish movement can indicate a continuation or reversal of the prior trend direction.

Ascending triangle: Generally speaking, the ascending triangle emerges in the same direction as the trend that existed just before the triangle formed.

Descending triangle: The descending triangle shows traders that the demand for an asset is weakening as the price breaks below the low support levels, with downward momentum likely to continue.

Symmetrical triangle: Due to a price breakout or breakdown that initiates a new bullish or bearish trend, the symmetrical triangle continuation pattern indicates a time of consolidation.

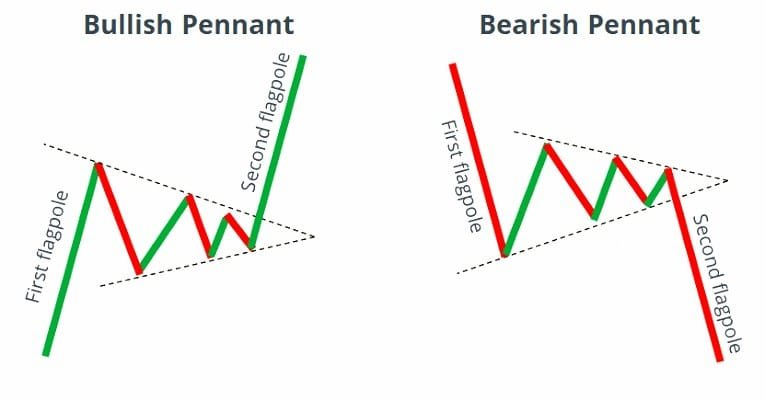

Pennant Patterns:

When price movements are becoming closer and closer between the support and resistance levels over time, pennant patterns which resemble a flag or triangle on the chart—occur. When there are at least five touches of resistance and support, this pattern is typically regarded as a pennant. The pennant continuation pattern, like rectangle patterns, can be created by either bearish or bullish market swings.

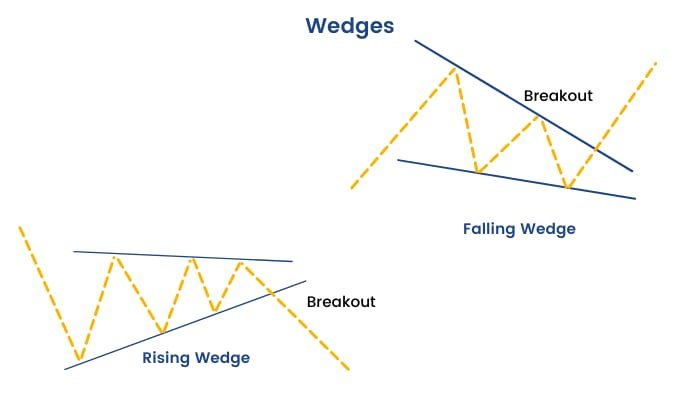

Wedge Patterns:

Converging trend lines, where the two lines are marked to connect the corresponding highs and lows of a price series, are used to display a wedge price pattern on a chart. The wedge indicates that there will be a halt in the present trend. A rising wedge is a bearish pattern with upward-facing lines that appears in a downward trend. A falling wedge is found in an increasing trend and is a bullish Crypto Chart Patterns with lines dropping down.

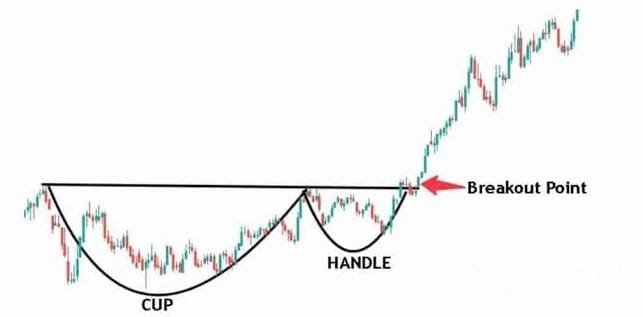

Cup and handle patterns:

The two little or big time spans, such daily or monthly, can be used to construct the cup and handle pattern. The cup and handle pattern, known as such owing to the shape it takes on the chart, is a bullish continuation pattern and Crypto Chart Patterns. This can happen when a rising pattern breaks and recovers, then experiences a rally that is comparable in volume to the previous downturn.

The handle portion of the pattern is formed on the right side of the cup, with the chart moving sideways or drifting downward, which may cause the instrument to breakout to a height greater than the beginning of the cup. The cup portion of the pattern is shaped like the letter “U,” with equal sides on both sides.

1 thought on “Highly Accurate Crypto Chart Patterns for Traders”